views

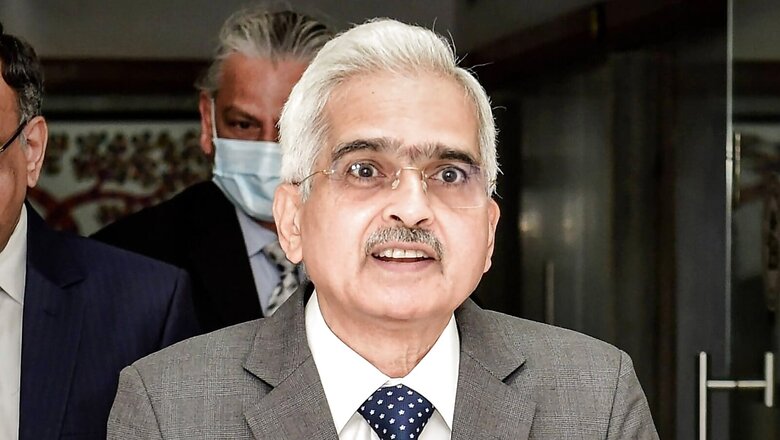

The 597th meeting of the Reserve Bank of India’s central board of directors was held on Friday at its regional office in Jaipur. During the meeting, which was chaired by RBI Governor Shaktikanta Das, among the issues reviewed were the current economic situation, global and domestic challenges, including the overall impact of current global geopolitical crises.

“The Board also discussed various areas of operations of the Reserve Bank including the functioning of the Local Boards and activities of select central office departments,” the RBI said in a statement on Friday.

RBI Deputy Governors Mahesh Kumar Jain, Michael Debabrata Patra, M Rajeshwar Rao and T Rabi Sankar; and Sanjay Malhotra, secretary in the Department of Financial Services; also attended the meeting.

Meanwhile, on Wednesday, in his keynote address at the SAARC FINANCE Seminar hosted by India, Patra said inflation trajectory continues to be “heavily contingent” upon the evolving geopolitical developments, international commodity prices and global financial sector developments.

He also said, “Although it (inflation) appears to be moderating from its peak of 7.8 per cent in April this year, we would prefer to await more incoming data before we are convinced that this a durable trend.”

In a recent interview with ET Now, RBI Governor Shaktikanta Das also said, “So far as inflation is concerned, it is getting increasingly anchored. We (recently) reached the peak at 7.8 per cent and thereafter, the inflation has moderated in the subsequent three prints and the latest was 6.7 per cent (in July). If you see what analysts are saying and how market participants are looking at the economy, we do a survey of professional forecasters, we do a survey of investors, we also do a consumer survey and a household survey; all these are indicating to the fact the expectations around the inflation are getting anchored.”

He, however, said there is absolutely no room for complacency as the consumer inflation is still around 6.7 per cent. “We need to bring it down to, first, below 6 per cent and then move closer to the target rate of 4 per cent.” Das also said there are uncertainties like geopolitical developments, spillovers, how the dollar appreciation is taking place, and inflation scenario in advanced economies.

The retail inflation in July, based on the Consumer Price Index (CPI), declined to 6.71 per cent, compared with 7.01 per cent in the previous month. The food inflation in July 2022 also moderated to 6.75 per cent as against 7.75 per cent in June.

However, July was the seventh consecutive month when the retail inflation remained above the RBI’s tolerance range of 2-6 per cent. The retail inflation in June had stood at 7.01 per cent, which was slightly lower than 7.04 per cent in May. Inflation in rural areas in June was at 7.09 per cent during June 2022, while that in urban areas was 6.92 per cent.

Read all the Latest Business News and Breaking News here

Comments

0 comment