views

Finding Vendors

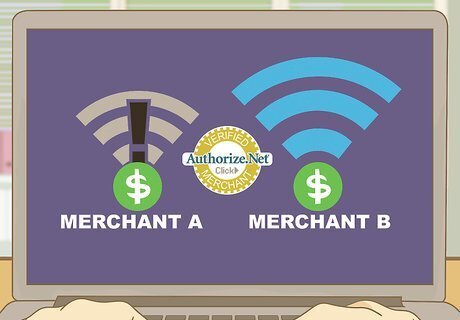

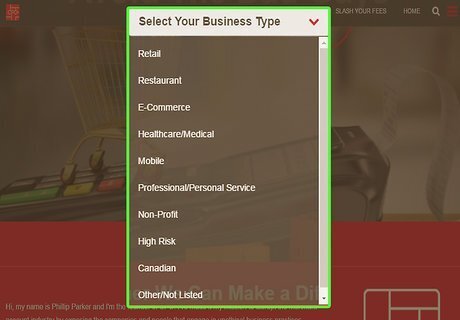

Identify your options. You have two options for accepting credit cards online. Identify which is the best option for you: Merchant account/payment gateway provider combo. An internet merchant account gives you the ability to process credit and debit card payments. You typically get these accounts at a bank. You’ll also need a payment gateway provider to coordinate payment from the customer’s bank to your bank. All-in-one solutions. Many payment gateway providers also now offer all-in-one solutions. You won’t need to apply for a merchant account at a bank.

Analyze the advantages and disadvantages of a merchant account. Merchant accounts aren’t for everybody. Before going forward, consider the pluses and minuses: It is more complicated to hook up the payment gateway to your merchant account. If you aren’t tech savvy, you might want to go with an all-in-one solution. It takes longer to get up and running because you have to apply for your merchant account and payment gateway account separately. However, a merchant account probably comes with fraud protection. The account will also be protected by the FDIC because it is offered through your bank. You will also have control of the transaction. However, you will also be responsible for resolving disputes with customers, which you might find time-consuming.

Consider the advantages and disadvantages of an all-in-one solution. A merchant account might not be for everybody. Instead, you should consider the pluses and minuses of using an all-in-one solution from a third-party merchant to process your credit card payments. Consider the following: You won’t need to be approved by a bank, like you will for a merchant account. If you have a low credit score, then an all-in-one solution from a third-party merchant might be ideal. The merchant will handle disputes with customers. Some third-party merchants are very well-known and trusted by the public. You can sign up much faster and get up and running within a day or two. However, you’ll probably receive less personalized service than you will if you have a merchant account and a payment gateway provider.

Ask your bank for a merchant account. Banks view a merchant account as a line of credit. Because most banks issue credit cards, you should stop into your bank and ask if you can get a merchant account with them. If your bank won’t extend you an account, try other banks in your area. You may need to open a personal or business account with the bank before they will consider you for a merchant account.

Find payment gateway account vendors. You can generally find them online. Many payment gateway vendors also provide all-in-one solutions, so you can research those as well. The following work regularly with small businesses: Authorize.Net CyberSource Due PayPal Verisign

Look closely at PayPal. PayPal has high name recognition. In fact, you’ve probably used PayPal to buy items online. They offer two different credit card processing solutions for businesses. Consider whether either is right for you: Website Payments Standard. You can accept all major credit and debit cards with Standard. Integrate PayPal into your shopping cart or use PayPal’s shopping cart. Consumers will not need a PayPal account to pay. Website Payments Pro. With Pro, PayPal is invisible on your website. Customers stay on your website for the entirety of their transaction. Pro’s virtual terminal allows you to process payments for fax, mail, and phone orders.

Choosing a Vendor

Compare fees. You’ll have to pay to have your credit card transactions processed. In fact, vendors typically charge many fees as part of their service. As you compare vendors, pay close attention to the following: Processing fees. Generally, an account with fewer than 1,000 transactions a month will pay monthly processing fees in the $10-100 range. Transaction fees. Typically, transaction fees range from 0.5% to 5% of the transaction plus 20-30 cents per transaction. Also check whether this is a fixed fee, or if it fluctuates. Startup fees. Ask whether or not these can be waived.

Check what extra services are provided. Third-party vendors often provide add-on services that makes using them very attractive for small businesses. Ask what other services they provide, such as the following: Website builder. You might not even have your e-commerce site or website up and running. If not, a third-party merchant could provide support. Mobile credit card processing. You might also have customers use credit cards in person. Ask if the merchant provides a processing dongle. Loyalty programs or gift cards.

Ask about customer support. Ideally, your online shopping cart will integrate seamlessly with your website and be up and running within a day or two. Often, however, there are problems. You should find out what kind of customer support the vendor offers. Check if they have a call center you can reach. Sometimes, all-in-one providers don’t have any phone number you can call. Instead, you ask questions by email.

Read reviews. The best way to get a feel for a vendor is to talk to other consumers. If you know another business owner who accepts online payments, ask them what vendor they use and whether they would recommend the company. Also look online for reviews. The website www.cardpaymentoptions.com collects consumer reviews.

Read the contract closely before signing. Often, contracts contain hidden fees that will be a nasty surprise in the future. Accordingly, you should read your contract closely. Show it to an attorney if necessary. You shouldn’t sign a contract until you understand everything in it. For example, your contract might include hidden maintenance fees. These can add up and might make a vendor more expensive than other competitors you could go with. If you’re a small business, you also should avoid getting locked into a long-term contract. Your business might not survive very long, and you may have to pay a high early-termination fee.

Comments

0 comment