views

X

Research source

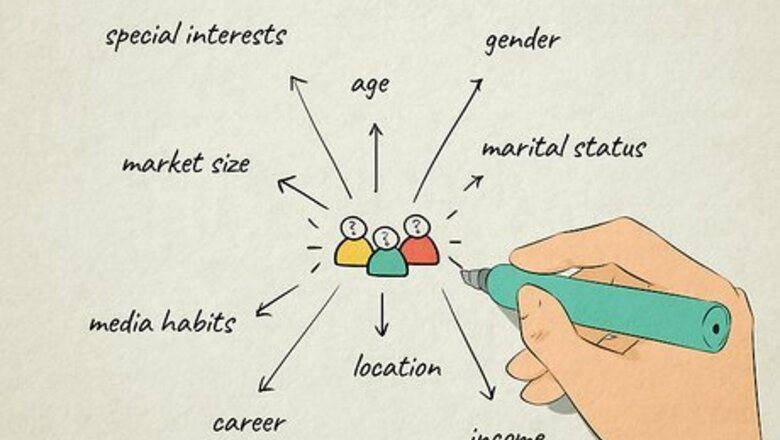

Market Analysis

Identify your target consumers based on the product or service offered. For some opportunities, your target consumer will be spelled out for you. But many require you to do a little research on your own to determine who in your community would be most likely to need the product or service you would offer. For example, if the business opportunity involves providing medical billing services, your likely consumers would be doctors and other healthcare providers. If you're selling retail products, search online to figure out who buys those products most often. For example, if the opportunity involves selling "athleisure" apparel such as yoga pants, you could search the brand to see the types of people on social media who are wearing that type of clothing.

Talk to people in your community to understand demand. Use social media to reach out to likely consumers of the product or service and find out if they'd be interested in buying from you. Looking at other people's posts and interests also gives you a good idea of potential demand. For example, if you're looking at buying a restaurant franchise, you might ask how many people in your community ate that type of food and how often they ate it. You might also find out how many times per week they ate out or got take-out or delivery rather than cooking meals at home. What you find out from your conversations should give you a general idea if your business is likely to take hold in your area. If you determine that it's not, you might want to start looking at different opportunities.

Scout out your competition. Search online to find other locations with the same branding. If the local market is already saturated, you may have a hard time establishing a foothold. Similar products or services that meet the same need can also lock you out of the market unless you can show that what you have to offer is superior. If you're looking at an MLM opportunity, pay close attention to your friends and family, since they will likely be your first customers. If there are already a handful of people in your circles selling the same product or service, it's probably a better idea for you to choose something else.

Read up on trends in the industry. Is this opportunity on the cutting edge or is it on its way out? The only way to know is to find out what's hot in the relevant industry or sector. A simple online search for "trends" along with the name of the industry is a good starting point for your research. You might also look up the brand itself and see what's being said about it in news and industry publications.

Product Evaluation

Try out the product or service yourself to see what you think. It's easier to sell a product if you're passionate about it! If you're going to invest in a business opportunity, it should be something you believe in and think that others should have as well. Your enthusiasm will be contagious. If the product or service isn't something you'd use yourself, talk to people who would and get their impressions of it. For example, if you're looking at a medical billing opportunity but you aren't a healthcare provider, talk to someone who is.

Read reviews from others who have used the product or service. Search for the product online and on social media to see what people are saying about it. A lot of complaints could be a red flag—look into them more closely to see what the problems were and whether they were resolved. Reviews can also help you manage expectations of the product or service if you do ultimately take advantage of the business opportunity. It's just as important to know what the product can't do as it is to know what it can.

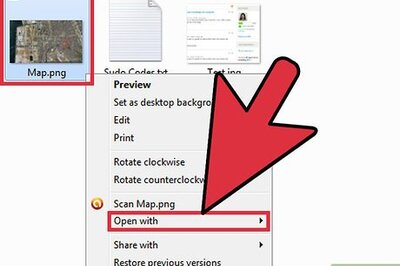

Look up information online about the product and brand. Do a search for the brand or the product offered and see what kind of press it's getting. Focus on the reputation the company has and how the quality of the product or service is being assessed. You may have already learned some information about the company when you were doing your market analysis, but at this stage, you're more interested in the reputation the company has for delivering a quality product and solid customer support. If the company has changed its branding, find out why. Often, when a company changes its branding, it's to get away from bad publicity surrounding poor quality products or even a lawsuit.

Visit similar businesses to better understand day-to-day operations. Talking to other business owners who've taken advantage of similar opportunities helps you get a better idea of what it's like to own that business. These business owners can tell you about their experiences, what you have to look forward to, and what you should avoid. For example, if you're thinking about buying a franchise, you might stop by the locations of several other franchises to see how things operate. Simply observe for a few minutes before you ask to speak to the owner or reveal that you're thinking about buying into the franchise yourself.

Budget and Finances

Calculate how much money you'll need to start your business. Business opportunities typically require an upfront investment—but that's usually not all. You may have to buy products, lease space, build a website, or buy equipment. These are all expenses that you'll have before you ever start the business—also known as seed money. For example, if you want to start a medical billing business, you might need to buy a new computer or other electronic equipment before you can get set up. The person or company selling the business opportunity will tell you exactly how much you need to pay them. In addition to that, they'll typically also tell you what other equipment, space, inventory, or other things you need to have in place before you can start. Some of these things you might already have, but others you'll need to buy. Ask your local small business association what sort of licenses you'll need to start your business. Cities typically require you to have a business permit if you're operating a brick-and-mortar store, but you might need one even if your business is completely online.

Look at your personal budget to determine how much money you have available. Look several months into the future to make sure you'll still be able to cover your household expenses after you've put money towards the business opportunity. It could take at least that long before the business starts turning a profit. If you don't have enough money available to invest immediately, figure out how much you'll have to put aside each month to meet your goal. Even if you can't start now, you might be able to swing it in a few months.

Estimate how much time you'll need to spend on the business. You may have heard that "time is money." Typically, the more time you spend on a business, the more money you'll make—but that might not always be the case. If you already have a full-time job, your time outside of work is valuable. Make sure the business opportunity won't cut into the time you have to relax or spend with your family. For example, if you're looking at buying a franchise, you'll likely be spending 60-80 hours a week at the business to get it off the ground before you ever see a profit. MLM opportunities, such as selling cosmetics or health products, typically don't require much of a time investment. However, you're unlikely to make a lot of money with these opportunities and may end up spending more than you make on products.

Create a budget for the business with cost projections. With your initial investment and startup costs, your business is starting from a deficit. You might also have additional costs each month your business is in operation. Your budget helps you determine when you might overcome that deficit and start earning a profit from your enterprise. Try to create an initial budget that will cover the first 18 months of the business. Your local small business association likely has templates you can use for your budget and cost projections that will help you keep your information organized and make sure you don't miss any important details.

Ask the person selling the opportunity when you'll see a profit. While someone selling a legitimate business opportunity isn't going to offer you any guarantees, they can usually provide you with statistics for when others began to turn a profit. This information can help you determine if the business opportunity is right for you. In general, assume that you'll be working for several months before you'll start to turn a profit. Be wary of people selling business opportunities that claim you'll be able to turn a profit in the first month or "quit your day job" after only a few weeks. People selling business opportunities typically show you "success stories." Ask for statistics relating to the average person who invested in that particular business opportunity to get a better idea of how the opportunity could work for you.

Risk Assessment

Read the legal disclosure documents carefully. Companies offering business opportunities are required to provide information about the risks you face when you invest in that opportunity. Take your time to read these documents and ask questions about anything you don't understand. If the seller of the business opportunity tries to rush you into making a decision or tells you that you don't have to read the disclosure documents, consider this a red flag. Sellers of business opportunities usually won't make any claims or guarantees about how much money you'll make. But if they do, they have to provide additional documentation so you understand what the seller is basing those claims on.

Ask for the financial reports of the company selling the opportunity. If the company that's selling you a business opportunity is having trouble financially, that could ultimately mean serious trouble for you. If they're selling the whole business outright, you want to know exactly what you're getting into. If they're licensing the right to sell their products or services, on the other hand, you need to know how strong that brand is. If the company won't release financial reports to you, that could be a red flag. Do some research on your own to see what you can find out about the company. Public documents available online often tell you a lot about a company's stability. Have an accountant or business attorney look over the financial reports for you if you're not comfortable analyzing these on your own. And even if you think you've got a pretty good handle on them, it still doesn't hurt to get an expert opinion before you jump on the opportunity.

Hire an accountant or attorney to look over the business paperwork. Rest assured that the company offering the business opportunity had attorneys and accountants to help them draft the contracts to protect their interests. Even if you're not investing a ton of money to start out, it's still a good idea to have someone look over the paperwork that will protect your interests. Many attorneys provide a free initial consultation. Beyond that, they're often willing to look over contracts and paperwork and offer advice for a flat fee. It's worth the cost for the peace of mind you'll get knowing that you had someone in your corner looking out for you.

Check local laws and regulations to make sure the business is allowed. Businesses that work with restricted products or services, such as those that deal with alcohol or marijuana products, might be illegal in your local area. Check online or with your local chamber of commerce if the business is dealing with restricted products. If you're working with restricted products or services, you might also need to get additional licenses or permits that you wouldn't need otherwise. An attorney can help you with this.

Form a limited liability company (LLC) to protect yourself. With an LLC, your business is kept separate from your personal finances, so you're not personally liable for any of your business losses or debts. It's relatively simple to set up and maintain an LLC. Although you can get an attorney to draft the paperwork for you, this usually isn't necessary. Your state's secretary of state likely has forms available online that you can download and fill out yourself.

Comments

0 comment