views

Choosing an Investment Vehicle

Use a domestic option instead of buying stock directly. If you want to gain exposure to the Japanese market, your best options are ETFs, ADRs, or domestic-issued investment funds. Buying and managing stock directly through the Tokyo Stock Exchange is impractical if you’re not fluent in Japanese, knowledgeable about Japanese brokers, and well-versed in the tax systems of both Japan and your nation. Unless you’re an experienced trader, purchasing foreign equities directly could result in high costs and tax implications.

Choose an online broker, if you haven’t already. You’ll need a brokerage account to purchase shares in investment funds that trade stock in Japanese companies. You have a choice between full-service and discount brokers. Full-service firms offer extensive investment advice, but charge higher fees. Discount firms are cheaper, but they offer fewer services. Use resources such as the Financial Industry Regulatory Authority (http://www.finra.org/) and Morningstar (http://www.morningstar.com/) to evaluate brokerage firms and investment funds.

Opt for a diversified investment vehicle. ETRs, mutual funds, and investment trusts are, generally speaking, diversified investment options. They’re funds that hold shares of a broad range of companies, which spreads out risk. If you purchase an American Depositary Receipt, or ADR, you’re only purchasing stock in a single company, so your gains are all dependent on that company’s success. A diversified investment vehicle lowers risk, but purchasing ADRs could be a single component of a larger diversified portfolio. You just don’t want to put all of your eggs in one basket. Typically, having a financial manager handpick which companies to invest in, which is the case with mutual funds and investment trusts, further lowers your risk.

Discuss your incurred tax liability with your broker or accountant. Investing in foreign stock can result in complex tax liabilities. In many cases, ETFs are your most tax-efficient option. Earnings are typically taxed as capital gains at a lower percentage than income tax. Your broker or accountant can let you know if an investment could incur a high tax bill. For example, if you live in the UK, you need to invest in an ETF that has either reporting or distributor status. Around 75% of UK-issued ETFs bear one of these classifications. However, most US and Eurozone ETFs do not have reporting or distributor status. Earnings from these ETFs could be charged as regular income and taxed at rates up to 50%.

Investing in an ETF

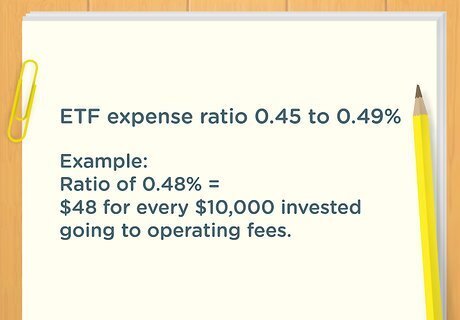

Shop for an ETF with an expense ratio around 0.45 to 0.49%. An expense ratio is how much it costs a firm to manage an investment fund. An expense ratio of 0.48% means $48 for every $10,000 invested goes to operating fees. Passively managed index funds usually have low expense ratios (as low as 0.05%), while actively managed funds have much higher fees (1% or higher). EWJ, DWX, and DBJP, 3 of the top listed ETFs tracking the Japanese exchange, have expense ratios between 0.45 and 0.48%. At 0.49% HEWJ is slightly more expensive, but it’s a currency hedged portfolio. This means it eliminates risks associated with the yen’s value relative to the dollar. Keep in mind you’ll also pay your broker a commission each time you buy or sell ETF shares.

Go with a currency hedged ETF to eliminate currency exchange risk. It might seem strange, but a weak yen correlates with a strong Tokyo Stock Exchange. However, this translates to a currency exchange risk, which could decrease your investment gains. A currency hedged ETF, such as HEWJ, trades in multiple foreign currencies to neutralize the risk of devaluation. If your ETF is unhedged and trades in dollars, euros, or pounds, you could lose your gains because the yen is devalued against your currency. For example, if your unhedged ETF’s value increased 10% in a year that the yen plummeted relative to the dollar, you might actually gain 5% due to the weak yen.

Purchase shares through your broker when you’re ready to buy. When you’ve chosen an ETF, log in to your online brokerage account or call your broker. Order the purchase and pay the transaction fees (expense ratio plus commission). Ensure you’ve provided your bank’s routing number so you’ll see returns on your investment. One of the perks of purchasing ETF shares is that there are no minimum deposit requirements. You can buy as little as 1 share. A disadvantage is that you’ll have to pay transaction fees each time you buy and sell, so you might want to make 1 larger deposit instead of a monthly contribution. If your discount broker charges $9.99 per trade (plus commission), it wouldn’t make sense to invest $100 per month in an ETF and pay over 10% per transaction.

Using Other Investment Options

Choose a mutual fund or investment trust for more active management. ETFs track the performance of a range of companies on the Japanese stock exchange. Mutual funds and investment trusts employ a financial manager who hand picks companies. A strategically designed portfolio could lead to larger gains and reduce risk, particularly in the short-term. An actively managed fund costs more. Expense ratios are typically around 0.75% to 1%. Top rated US-issued mutual funds include Fidelity’s Japan Smaller Companies Fund (FJSCX) and DFA’s Japanese Small Company Fund (DFAJSX). Recommended UK options include GLG Japan Core Alpha, Schroder Tokyo, and Baillie Gifford Japan Trust.

Invest in a sponsored ADR if you want stock in a single major company. ADRs, or American Depositary Receipts, are either sponsored, which means the foreign company endorses its shares traded on the New York Stock Exchange (NYSE), or unsponsored. Investing in a sponsored ADR is lower risk and more reliable than investing in an unsponsored ADR. Japanese ADRs listed on the NYSE include Canon, Honda, Mitsubishi, and Toyota. While these companies are more established, remember that there’s always a risk of loss. For example, a recall could cripple an automobile manufacturer’s share price. Always diversify your investments and incorporate any ADRs you purchase into a larger investment plan. An ADR is created by a depository bank, which purchases and trades shares in a foreign company. The bank sets a conversion rate, which is how many local shares (in this case, shares in Japan) an ADR is worth. Currency exchange rates figure in this conversation rate, so keep the yen risk in mind. A devalued yen against the US dollar could decrease your gains.

Avoid global or international bond funds. International bond funds are an inexpensive, popular investment option. Japanese bonds over the last 10 years have consistently fallen and have dipped in and out of negative yield. While investing in 20-year bonds could lead to small gains, there just isn’t much incentive for the average investor to purchase Japanese government bonds or invest in a fund that tracks them. When you invest in bonds, you purchase a share of a government’s debt, which accrues interest and reaches its face value (or matures) after a set number of years. They’re usually considered low-risk, low-yield investments. ETFs that track government bonds are cheap, with expense ratios around 0.05%. However, don't expect returns to be higher than a fraction of a percent. If the yen appreciates substantially within 20 years (or whenever the bond reaches maturity), it would offset the bond’s negative yield and could offer modest positive gains. Still, other investment options offer higher gains with low to moderate risk.

Comments

0 comment