TAX

GST Evasion Of Rs 345 Cr Detected Against Lottery Distributors Till Nov 2023: FinMin

A total of 12 cases of GST evasion involving Rs 345 crore have been detected against lottery distributors since July 2017.

Budget 2024: Hike Tax On Tobacco Products, Urges Doctors & Public Health Groups

Health taxes are excise taxes imposed on products such as tobacco that have a clear negative public health impact.

GST Collection in October 2023 Jumps 13% YoY To Rs 1.72 Lakh Crore; Second Highest Ever

The average gross monthly GST collection in the FY 2023-24 now stands at Rs 1.66 lakh crore

How Can NRIs File Form 10F Without Obtaining PAN Number?

In the absence of an individual's PAN, TDS is deducted at a higher rate.

IT Dept Extends ITR Filing Deadline For Charitable Trusts, Professional Bodies; Check Details Here

The Income Tax Department has extended the income tax return filing deadline for charitable trusts, religious institutions and professional bodies

Income Tax Refund: Govt Planning To Reduce Average Time From 16 Days To 10 Days, Says Report

About 6.91 crore ITRs have been filed for the current assessment year 2023-24. Out of these, 4.82 crore ITRs have been processed

Gross Direct Tax Collection Grows 15.7% To Rs 6.53 Lakh Crore So Far In FY24

Refunds amounting to Rs 69,000 crore have been issued till August 10

Landmark GST Ruling! ITC Can't Be Denied Automatically For Non-Payment Of Taxes By Supplier, Says Calcutta HC

In case of a default in payment of GST by the seller, recovery shall be made from the seller, says Calcutta High Court while setting aside the reversal of input tax credit availed by Suncraft Energy due to GSTR mismatch

51st GST Council At 4 pm Today To Finalise Modalities For 28% Tax On Online Gaming

The GST Council is likely to finalise the modalities for determining supply value in online gaming and casinos for levying 28 per cent tax

ITR Deadline In Just 3 Days: What Happens If You Miss The Last Date of Income Tax Return

ITR Filing Deadline: Over 5 crore income tax returns have already been filed, here's what happens if you miss the July 31 income tax return deadline

Attention Taxpayers! ITR Deadline Not Extending For AY 2023-24? Income Tax Department Says THIS

ITR Deadline 2023 Update, Income Tax: The income tax department says it will continue to provide support till July 31, including Saturday and Sunday

Income Tax Return: What Does Clubbing of Income Mean in Your ITR?

The concept of clubbing income plays a significant role in assessing an individual's tax liability

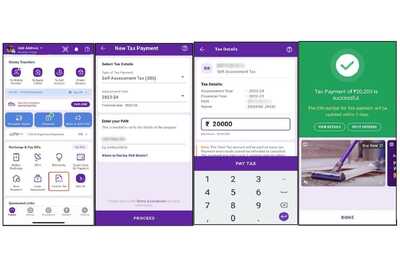

PhonePe Launches Income Tax Payment Feature On Its App; Details Here

Pay Income Tax Via PhonePe: The feature allows taxpayers, both individuals and businesses, to pay self-assessment and advance tax directly from within the PhonePe app

Income Tax Refund: Keep THESE Things In Mind To Avoid Any ITR Refund Delay

ITR filing: If your final tax liability is lower than your total TDS during the year, you will get a refund; if liability is higher, you will have to pay the difference

Karnataka HC Quashes Rs 21,000-Crore GST Notice Against Bengaluru-based Online Gaming Platform

Gameskraft, an online skill-based gaming platform that began operations in 2017, applauded the HC verdict and said it was a clear vindication of the company's business model

Are You Prepared? Income Tax Due Dates For May 2023 Revealed!

Income Tax Due Dates: Some of the key dates that taxpayers need to be aware of in May 2023.